Canada has released a framework for sustainable investing outlining actions it sees as being in accordance with the nation’s climate ambitions. Yet experts warned that some of the rules would extend the existence of toxic industries.

The Sustainable Financial Action Council of Canada (SFAC), which created the taxonomy report, has approved investment in two different categories for activities that are thought to be consistent with achieving the nation’s climate commitments.

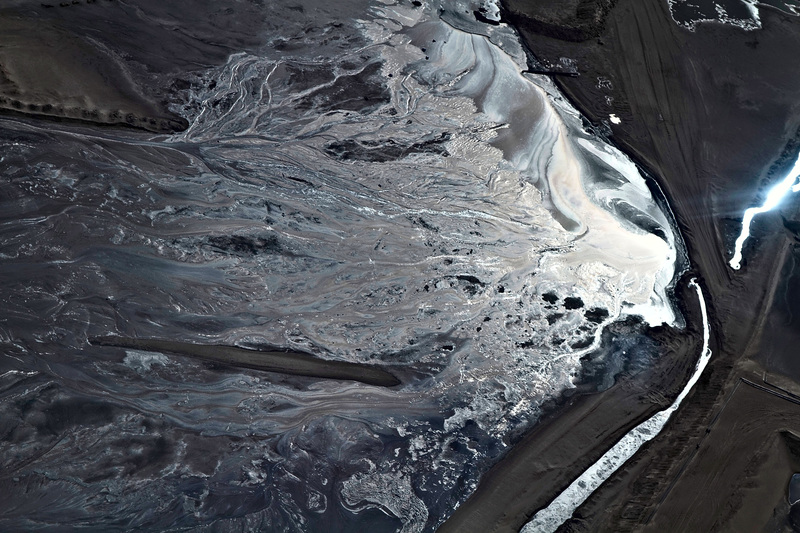

The plan does not involve new investments in coal, oil, or gas projects, but it may cover CCS improvements to oil sand production, sequestered concrete manufacturing, blue hydrogen production, and electric steelmaking.

According to the report, all investment operations must take scope 1, 2 and 3 emissions into account and be in line with Canada’s goal of becoming net zero by 2050.

Read Also: Study highlights cities’ ability to absorb rainfall, prevent floods in Africa

According to some of its authors, it will lessen market uncertainty and make up the $115 billion annual funding gap needed to achieve the nation’s climate target.

Adam Scott, however, noted that some of the transitional activities listed lack a “credible” decarbonization route. Adam Scott is the director of the Canadian nonprofit Shift Action for Pension Wealth and Planet Health.

In his words, “Steel and cement and fertiliser and other hard-to-decarbonise industries will need continued finance to make a transition, but there’s a credible argument that they have a pathway or they could reach their emissions through technology.

“If you continue to finance oil and gas, though, you’re actually delaying the transition. You’re essentially saying: ‘We’re going to bet against electrification by making marginal emissions reductions which have no path to zero’.”

Story was adapted from Climate Home News