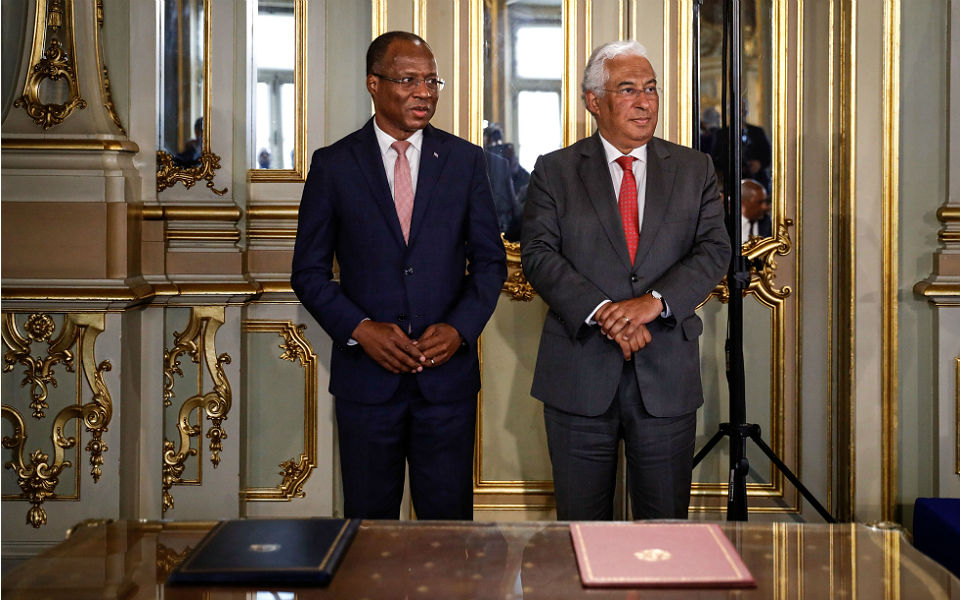

Portuguese Prime Minister Antonio Costa has said Portugal has signed an agreement to swap Cape Verde’s debt for investments in an environmental and climate fund that is being established by the African nation.

Such “debt-for-nature” swap deals are an emerging phenomenon in other countries and are part of attempts to resolve a dilemma faced by world leaders on how and who will foot the bill for actions taken to reduce the impact of climate change.

A former Portuguese colony, Cape Verde is already suffering from rising sea levels and significant biodiversity loss due to increasing ocean acidity and owes around 140 million euros ($152 million) to the Portuguese state and over 400 million to its banks and other entities.

Read also: Gates invests in Australian start-up to reduce methane emissions of cow burps

According to Costa, 12 million euros of debt repayments to the state scheduled until 2025 will be put in the fund, and ultimately “the entire amount of debt repayments” will end up there, allowing Cape Verde to invest in energy transition and the fight against climate change.

“This is a new seed that we sow in our future cooperation. Climate change is a challenge that takes place on a global scale and no country will be (environmentally) sustainable if all countries are not sustainable,” Costa said during a state visit to Cape Verde in remarks broadcast by RTP television.

Although he did not specify if debt to Portuguese companies was part of the deal, he however expressed hope that companies “will also be involved in the various areas from energy efficiency to the production of renewable energy” or storage of green hydrogen.

Cape Verde Prime Minister Ulisses Correia e Silva said his country needed to urgently enable mechanisms and financing instruments to support such solutions and deal with natural emergencies.

Debt-for-nature deals can help as they can produce the so-called green and blue bonds to finance conservation efforts on and land and at sea, which appeals to a rapidly growing number of investors seeking to meet net-zero carbon emissions and other environmental goals.

Story was adapted from Reuters.